Author: Victoria Wilson

Independent theorist interested in questions at the intersection of real estate, value and price.

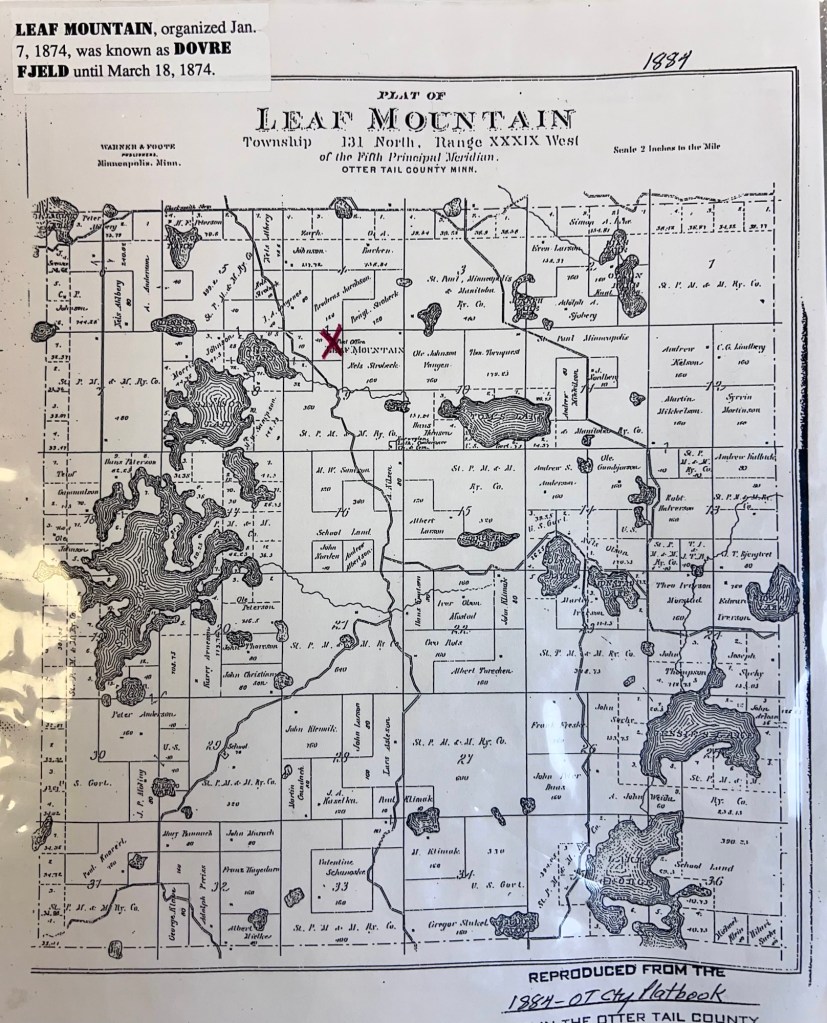

Plat map from 1884

I was digging around the county historical society lately because I thought it would be fun to find where my relatives made a land claim when they arrived in the US. Plat maps, which track ownership, were not updated on a routine basis in the days of primary forests and pioneer wagons. This one was done in 1884, and the next printed update didn’t get published until 1902. Even though the family of five children, all born in Norway, are said to have arrived in 1874, the family name has yet to appear here. It does in 1902.

What you do notice is the number of parcels denoted by St. Paul Minneapolis and Manitoba Ry Co. or St. P. M. & M. Ry Co. These parcels were owned by the railroad built by James J. Hill. The school land is also a major player. There were 168 schools in Leaf Mountain Township. The forty acre plots with no names listed, or US, are the ones open for homesteading. It seems the US government priorities rolled out in that order: transportation, education, and homesteaders to make it all work.

Where is the Midwest?

Shop Talk

A convo with ChatGpt: What does ‘shop talk’ mean

ChatGPT said:

“Shop talk” means conversation about work or a particular profession, especially when it happens outside of work or in social settings.

It often implies that people are talking about technical details, jargon, or inside-baseball topics that only others in the same field would fully understand — sometimes to the boredom of outsiders.

Examples:

- “Let’s not get into shop talk at the party — nobody else here wants to hear about accounting software.”

- “Whenever those two doctors get together, it’s all shop talk.”

So, it’s basically work-related conversation among colleagues or professionals, often used with a slightly negative or teasing tone (“ugh, enough shop talk!”).

You said:

Name three reasons why an outsider does not follow the insider baseball.

ChatGPT said:

Here are three clear reasons why outsiders often don’t follow inside baseball (or shop talk):

- Specialized Knowledge or Jargon – Insiders use technical terms, acronyms, or references that make sense only within that field. Outsiders lack the background to decode the language.

Example: A software engineer says, “We just migrated from monolith to microservices,” and a non-tech person hears gibberish. - Different Context or Priorities – Insiders share a sense of what’s important in their work — the stakes, the rivalries, the subtleties. Outsiders don’t know why those details matter.

Example: A debate about which research framework is superior means little to someone outside academia. - No Emotional Investment – Insiders are personally invested — their reputations, routines, and identities are tied to the topic. Outsiders lack that emotional hook, so the conversation feels dry or trivial.

Example: Two chefs passionately argue about knife brands while everyone else at the table just wants to eat.

You said:

Take these three reasons- are they not the features of an institutional network?

ChatGPT said:

That’s an astute connection — yes, those three reasons are very much features of an institutional network.

Let’s unpack that:

- Specialized Knowledge or Jargon → Bounded Communication System

Institutions build and maintain their own languages — technical terms, shorthand, and shared references that mark belonging. This linguistic specialization not only allows for efficiency among insiders but also creates boundaries that separate members from outsiders. It’s a classic form of social closure: if you don’t speak the language, you’re not fully in. - Different Context or Priorities → Shared Frames of Relevance

Institutional networks define what counts as important, legitimate, or meaningful. Insiders share a frame of reference shaped by the institution’s history, goals, and internal hierarchies. Outsiders, lacking that frame, can’t easily interpret why certain details matter. This is how institutions reproduce themselves — by shaping what participants see as relevant knowledge. - Emotional Investment → Identity and Belonging

Institutions aren’t just about rules and roles; they generate emotional commitments. People’s sense of identity becomes tied to their institutional membership — whether it’s a profession, academic discipline, or bureaucratic body. That investment reinforces the network’s cohesion and its internal culture, even as it alienates outsiders.

So in effect, “shop talk” and “inside baseball” are the micro-level expressions of institutional boundaries. They show how networks of practice sustain themselves through shared knowledge, values, and affective ties — precisely the stuff that makes them opaque to outsiders.

Fact of the Day

According to the National Fire Prevention Association, each year, 832 fires are started by faulty Halloween decorations.

Dynamic Private-Order Institutions

From a newly minted Nobel prize winner, Joel Mokyr.

Slowly, and perhaps not always quite perfectly, British formal institutions adapted. But the same was true for private-order institutions: the rather sudden rise of country banks in the second half of the 18th century illustrates the high degree of adaptiveness of private-order British institutions; they were not coordinated or supervised by some central authority, and no political revolution was necessary to bring them into existence. Yet once the circumstances were suitable and opportunities arose, these banks emerged almost ab nihilo. They replaced the informal activities of local merchants, notaries, and attorneys who had previously intermediated in credit transactions.

This natural and spontaneous progression of credit extension brought real estate ownership to the greater populace.

Read his insights at Ideas Mattered, But So Did Institutions.

Slow Horses- Series Review

This band of MI5 misfits shows real promise. All have backstories, with the leader of the crew showing the deepest scars of past wrongs. His assistant is haunted by tragedy with some sort of entanglement. There’s an assortment of others, including a team builder type and a digital guru extraordinaire. But it’s the two youngsters in the group– dashing and darling– who will engage the viewer the most.

After a bit of a dry spell, this series is one to look forward to for that hour of after dinner viewing!

Where the kids are

Or, in the case of Canada, are not.

It’s puzzling to me why children are not more popular. It’s puzzling why there are not more reports on all the benefits they bring. It’s only the up front investment people want to hold out as a drawback with short term myopia.

C’mon people, still?

Check out the number of views of the YouTube shorts where historian and author Sarah CM Paine punches out a history lesson in spurts of ironic and bell clear words- 2.3 million views, 1.6M, 8.5M.

Who is she? It’s hard to know because, despite her online presence, a Google search generates no profiles written about her. Her Wikipedia page has a new photo above a brief description. Only this to stand up for a long time academic who has penned a respectable number of books.

Granted, this new exposure is due to one person- Dwarkesh Patel. He has hosted and promoted Sarah CM Paine’s material. He gets full credit. And there are pleanty of profiles written on him such as in Time or here.

A Windy Day

The Wind- Emily Dickinson

It’s like the light, —

A fashionless delight

It’s like the bee, —

A dateless melody.

It’s like the woods,

Private like breeze,

Phraseless, yet it stirs

The proudest trees.

It’s like the morning, —

Best when it’s done, —

The everlasting clocks

Chime noon.

Tomato bounty

It was a good year for tomatoes.

What a grain elevator could say

The grain elevator was the most ubiquitous commercial building in Minnesota’s small and medium towns during the mid to late 1800s.

In most towns in western Minnesota, grain elevators were the dominant feature of the skyline 1837 Treaty | Minnesota DNR. As railroads expanded westward in the 1870s-1880s, grain elevators sprang up along every railroad line to store wheat and other grains before shipping them to Minneapolis and beyond.

This makes perfect sense given Minnesota’s economy at the time. Wheat farming dominated the landscape, and Red Wing held the title as the world’s largest primary wheat market in 1873, exporting 1.8 million bushels valued at more than two million dollars United States v. Sioux Nation of Indians – Wikipedia. Every town with railroad access needed a grain elevator to collect, store, and load farmers’ harvests onto railcars.

Typically, small services would pop up alongside the tall wooden structures. Or an eating and drinking establishment. Sometimes a church was erected down the road a bit. And for decades, the railroad infrastructure supported a node of activity in remote rural areas.

A shift occurred once the interstate system was established in the 1950s. Rail is still most beneficial for long hauls, whereas trucks carry the grain for shorter distances, typically under one hundred miles. With fewer stops, the isolated wooden elevators fell into disrepair. Often they fell for the useful purpose of serving as a training exercise for local firefighters.

The purpose of this short vignette is to show how land uses are tied intimately with public infrastructure. And these types of projects are engaged over long time frames. A slow natural progression of the property from peak usefulness to decline can be led by aging owners, people who can view themselves in a steady state for another decade or more. The insight for the outside observer to understand where in the process a parcel finds itself. And then to implement policy in relation to the receptive impulses of that moment.

The 70s were colorful

Out with the Mall

In with the residential new construction.

“Utilizing existing infrastructure can bring homes to the market quickly, avoiding some of the delays associated with redevelopment or greenfield housing development,” says Hannah Jones, senior economic research analyst at Realtor.com.®. “The shift from retail to residential is a logical solution in a country facing a persistent housing shortage.”

She added that malls in suburban states like New Jersey and Florida—both with well-established commercial corridors and housing pressures—are especially ripe for this type of redevelopment.

This from Realtor.com.

Pooch with passion

There was this sweet service dog at the airport the other day. A working dog, they call them, helping their owners overcome a sight impairment or a hearing decline. Emotional support animal designations are often used to help college kids bring their feline friends into the dorm. It’s the law that pets can skirt the law. If they meet the standard of a group objective, and an opening of access to those with disabilities meets a group desire level need. The puppy with whisky gold hair and large eyes isn’t a private pet but a public support. The pouch is a new thing even if she looks like the same old thing. And hence in this new nature, is tallied up in a different manner.

MN Railroad Fact

Minnesota’s Land Giveaway

Railroads received 9.9 million acres of Minnesota land from the federal government—more than the 7.3 million acres claimed by homesteaders between 1862-1880. The Homestead Act’s promise of land for ordinary settlers shifted when railroads got the biggest share. Now it’s difficult for any major infrastructure project to command overarching commitments.

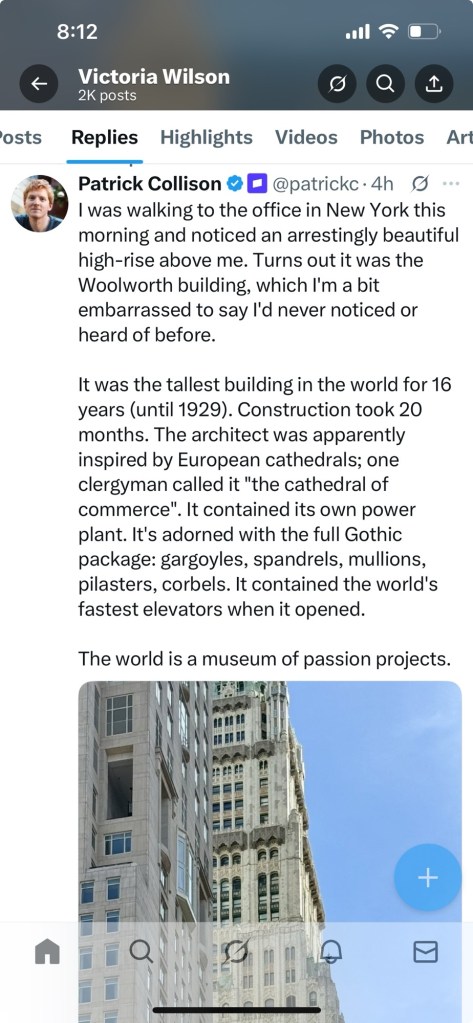

The Woolworth Building

Notes on passion projects by Patrick Collison:

A Melody

Road Talk

It’s no surprise that the homes abutting a freeway are a bit cheaper than similar homes with a buffer from the noise and hubbub. A recent paper, The Traffic Noise Externality: Costs, Incidence and Policy Implications was clever in using the construction of sound barrier walls to calculate the markets preference for a home protected by the wall versus one that was not.

The authors come up with a figure of 6.8%, which in itself is not as crucial as the acknowledgment that a public goods project, such as erecting a barrier wall, uniformly corrects the imposition of a busy road across a blanket geographic area. There is a market for public goods. A consistent, non-exclusionary response to a public goal reflected in the impassionate exchange of cash for homes.

The impact of the wall’s benefit, or the detriment of a noisy road, is reflected in the nearby neighborhood. There are other impacts resulting from the existence of the road and its location. It allows people to get to jobs. It might be an emergency route to a hospital where people object to the use of sirens. Buses might run off the road and so on. For that reason the net effect of the road is best taken as a package with the ability to divvy out and assess the pro’s and cons as refelcted in the surrounding land values.

To make a jump and try to use changes in house prices to make a meaningful observation of the traffic composition is a stretch. To extrapolate the value of home price change and reflect that back onto individual cars driving down that road, as the authors of The Traffic Noise Externality simply don’t follow me. It seems it would be a categorization problem.

the land let him down

Imagine you write a whole textbook only to find out you were on the wrong track. Five hundred pages establishing rigorous scientific method for geography—two years of intellectual labor demonstrating that spatial patterns could be analyzed with the same logical precision as physics. And then you look up from your equations and see Baltimore burning, students protesting, urban poverty that your elegant models somehow failed to predict or explain.

David Harvey himself had acknowledged in the book’s preface that he “wrote this book mainly to educate myself,” seeking to understand why his quantitative work kept producing “unpublishable papers.” 1 THE RIGHT TO THE CITY David Harvey He thought the problem was methodological sloppiness. He thought tighter logic and better statistics would solve it.

But standing in the ruins of American cities in the late 1960s, Harvey confronted a different possibility: perhaps the methods weren’t wrong exactly, but they were asking the wrong questions. You can’t model urban crisis without modeling capital. You can’t explain spatial patterns without explaining property. You can’t understand cities without understanding who owns the land and how they acquired it.

The textbook wasn’t false—it was beside the point. All that careful work distinguishing inductive from deductive inference, all those chapters on probability theory and classification systems, and somehow he’d managed to write 500 pages about space while avoiding the one thing that actually organizes space: value.

By 1973, Harvey had become a Marxist. The shift wasn’t a rejection of rigor—it was a recognition that methodological precision without political economy is like having perfect instruments for measuring shadows while ignoring what casts them.

“Explanation in Geography” remains a landmark. But it’s a landmark of a particular kind: a monument to what you can accomplish while carefully, meticulously, rigorously avoiding the most important question.

Does the land still have something to say?

Math rejected or Math unrequited?

Time and again, it turns out that those who reject math models are those without math skills.

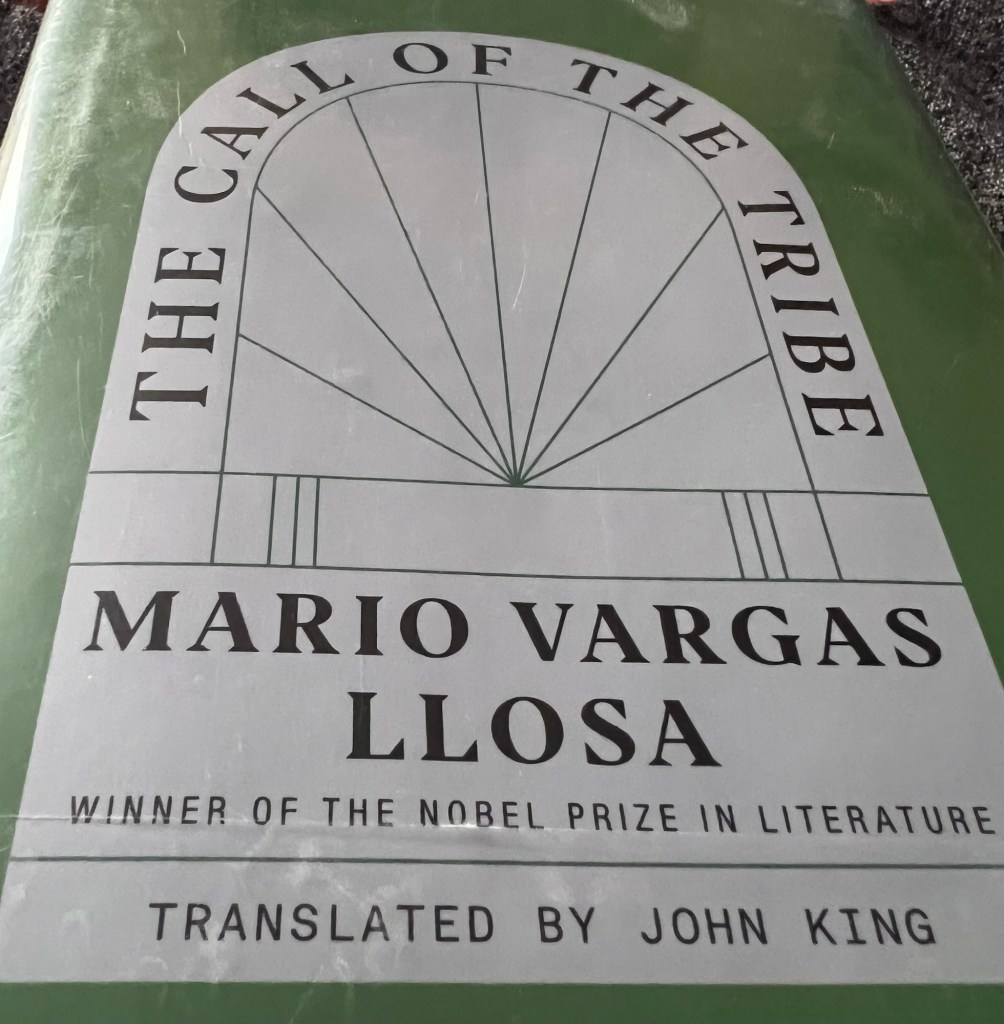

Discovering New Voices

One of the great rewards of reading broadly is encountering thinkers who challenge our assumptions in unexpected ways. John Cassidy’s new book Capitalism and Its Critics serves as an excellent gateway to such voices—including Silvia Federici, whose work I encountered for the first time through his analysis.

Federici builds upon Marx’s foundation while charting her own critical path. Like Marx, she argues that capitalism fundamentally depends on one group exploiting another’s labor—but she expands this critique beyond the traditional worker-owner dynamic. Her distinctive contribution lies in highlighting how capitalism systematically devalues and invisibilizes reproductive labor, particularly the unpaid work of mothers and caregivers.

Her proposed solution—direct payment for domestic and care work—has sparked both organizing efforts among women’s networks and genuine debate about the nature of care itself. There’s an inherent tension here: while some forms of labor may be best performed voluntarily rather than as market transactions, this doesn’t negate their immense economic and social value.

This raises a crucial point that transcends ideological boundaries: regardless of whether we embrace Federici’s specific remedies, her core insight about the systematic undervaluing of reproductive labor demands serious consideration. The work of raising children, maintaining households, and caring for family members provides enormous value to society—value that our current economic frameworks struggle to recognize or measure adequately.

In exploring these ideas, Federici reminds us that the most interesting economic critics aren’t just those who diagnose capitalism’s failures, but those who help us see the invisible foundations upon which the entire system rests.

Fall

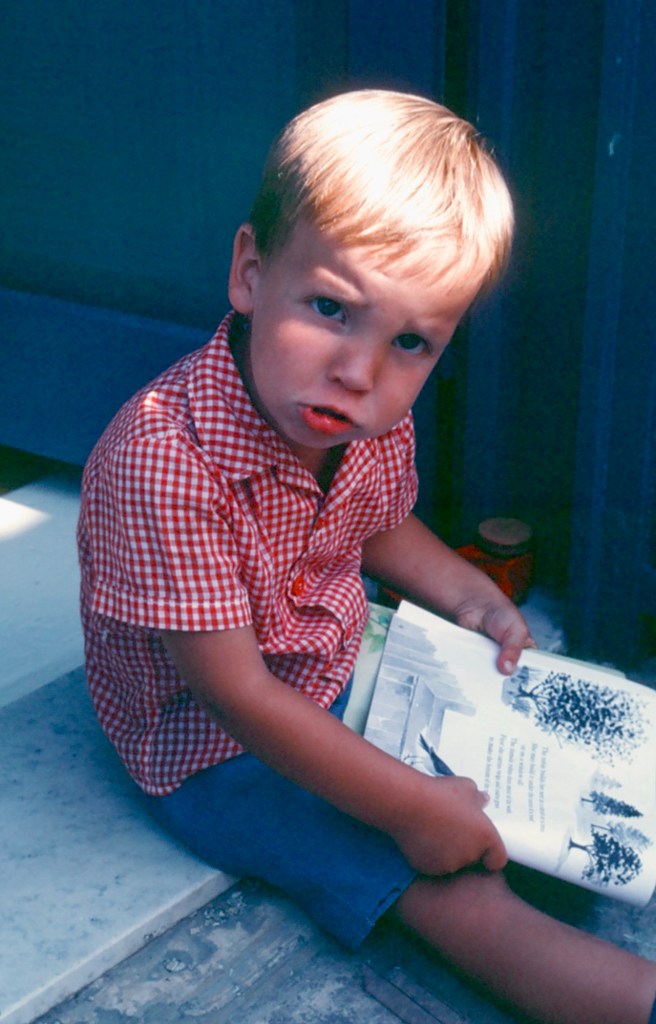

What is Private, What is Public Eastern block home edition

Those of you who follow this site know that we view the boundary between public and private as fundamentally a matter of choice. Bridges can be privately owned and charge tolls, but they more commonly become part of public transportation infrastructure. These decisions about what remains public versus private are often driven by considerations of efficiency and practical management. It was fascinating, then, to recently discover that following the collapse of communism in 1989, one of the most immediate and sweeping divestitures involved housing itself. Here’s that remarkable story.

The Great Housing Transfer: Eastern Europe’s Post-1989 Privatization Revolution

The collapse of state socialism in Eastern Europe triggered one of history’s largest transfers of public wealth to private hands through housing privatization. Between 1990 and the early 2000s, millions of state-owned apartments were sold to sitting tenants at deeply discounted prices, fundamentally reshaping the region’s housing landscape and creating lasting economic and social consequences.

From State Monopoly to Private Ownership

Under communist rule, Eastern European countries maintained near-total state control over housing. In most countries, 80-90% of urban housing stock was publicly owned, with the state serving as both landlord and developer. This represented one of the most comprehensive public housing systems in modern history, housing the majority of urban populations across the Soviet sphere.

The transition was dramatic and swift. Following the privatisation of state-owned housing in the transition to a market economy in the early 1990s, CEE countries now record some of the highest homeownership rates in the OECD, with over 70% of households owning their home outright. Countries like Hungary, Slovakia, and the Czech Republic saw homeownership rates soar from under 20% to over 80% within a single decade.

The Titling Process: Converting Tenants to Owners

The privatization process varied by country but followed similar patterns. Most governments opted for “sitting tenant” sales, offering apartments directly to current occupants rather than through open markets. The privatization policy of the 1990s aimed to make the sitting tenants owners of their rented flats, by offering 70–90 per cent discounts on the price of the houses and flats.

The legal titling process was often complex, requiring new property registries and cadastral systems. Many countries had to create entirely new frameworks for private property ownership, having operated under state control for decades. Voucher systems were also employed, where citizens were given or could inexpensively buy a book of vouchers that represent potential shares in any state-owned company, though these were more commonly used for enterprise privatization than housing.

The Value Transfer: A Massive Subsidy

The financial scale of these transfers was enormous. With discounts typically ranging from 70-90% below estimated market value, the programs represented massive implicit subsidies to sitting tenants. In Hungary alone, the value transfer has been estimated at several billion dollars in current terms. The Czech Republic’s privatization program transferred approximately 1.2 million units, representing roughly one-third of the entire national housing stock.

These discounts were justified as compensation for years of poor maintenance and recognition of tenants’ de facto investment in their homes through decades of occupancy. However, the beneficiaries were not necessarily the neediest—middle-class professionals and party officials often lived in the most desirable state housing and captured the largest windfall gains.

Lingering Effects: Winners, Losers, and Market Distortions

The privatization legacy continues to shape Eastern European housing markets today. The dramatic shift to homeownership created several persistent challenges:

Market Thinness: The formal rental market is generally thin and underdeveloped — only in the Czech Republic is the rental market home to more than 15% of households (19%). This limits labor mobility and creates barriers for young people entering housing markets.

Quality Degradation: Multi-apartment buildings dominate the housing stock, many built during the communist period. As a result, the stock is ageing and of poor quality. Most households cannot afford to maintain or upgrade their dwellings according to environmental requirements. The mass transfer of maintenance responsibilities to individual owners without corresponding financial capacity has led to widespread deterioration.

Social Housing Shortage: The social housing supply in most CEE countries is well below the OECD average, with the exception of Poland and Slovenia. The elimination of public housing left a gap in affordable housing provision that has never been adequately filled.

Inequality Effects: The privatization created a new form of wealth inequality, where accident of residential location in 1989 determined lifetime wealth accumulation. Urban professionals gained valuable assets, while rural residents and those in less desirable locations received minimal benefits.

The Eastern European housing privatization represents both a remarkable success in creating a property-owning democracy and a cautionary tale about the unintended consequences of rapid large-scale privatization. Three decades later, the region continues to grapple with the market distortions and social challenges created by this unprecedented transfer of public wealth to private hands.

Deep Cover- Movie Review

I’m usually critical of comedies, but I can recommend this one. Deep Cover follows three characters who meet in an improv class and gradually get pulled deeper into the street drug network, all under the guidance of an undercover cop. Orlando Bloom plays a manic actor-artist, Bryce Dallas Howard embodies the sharp-tongued former head girl turned mom-coach, and Nick Mohammed takes the brunt of the square punchlines.

But the story isn’t just about comedy—it’s about self-discovery. Each character is searching for a way forward in life, and the chance to step into another world allows them to see themselves from a fresh perspective. It’s the classic tension: the difficulty of truly facing oneself. Through improv, they begin to uncover truths about their own lives and the people around them.

Of course, the act of going “undercover” soon feels too real, and while they’re tempted to bail out, each turn forces them to go deeper. That push-and-pull creates both the comedy and the revelatory moments. By the end, they find their way back to the safety of their old world—bruised, a little wiser, and leaving the audience thoroughly amused.

Some art I saw today

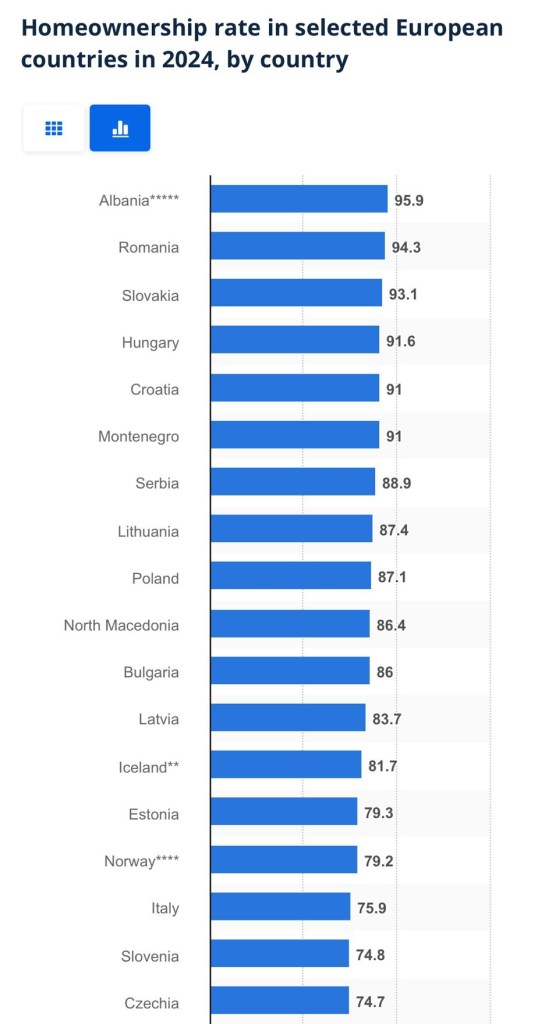

Follow up on European homeownership rates

Taken from today’s Bloomberg letter.

There’s a noticeable trend where countries with higher state capacity—broadly understood as the ability of a government to effectively implement policies, provide public services, and maintain robust institutions—tend to have lower homeownership rates. This pattern, while not absolute, holds across several key countries when examining the most recent data (2023–2024, primarily from Statista and Eurostat).

dance me

Want a Ride?

One thing to note if you are planning a trip to Denmark is that you can rely on public transportation with confidence. In Denmark, this covers trains, commuter rail, metro, buses, and the availability of bike lanes (of which there are shockingly many). Just because it is said that a bus will be at a certain place at a certain time, it does not always mean that it will be there. And if you are in a foreign place, you don’t have the background to think, Don’t worry, the E11 always runs a little late.

Cutting back on concerns is essential when you are on a trip. They are time-consuming. They make you rethink your plans. They drain the fun out of the adventure. And maybe they are the best way to judge the efficacy of a provided service.

In Denmark, all metro, commuter trains, and inter-city trains are accessible via an app. It’s straightforward and easy to use. You can book as you stand on the track. The bus schedules are also available electronically and at each stop. On board, the screens display the time, stops, and the time of arrival at each stop, among other information. A subdued Scandinavian kerfluffle of concern arose on one trip as the wagon had to stop at the central station and not continue as planned to the airport. There was an instant sharing of information among riders to ensure everyone was in the know.

Rail infrastructure is present across the country, whose land mass is only a fifth the size of Minnesota, but whose citizenry is very similar. With the main corridors of population running between the higher-density areas, it is not surprising (in a way) that rail can be the dominant form of transportation. In an area like the northern tip of Jutland, where the rail network is limited, buses take over. As far as I could tell, most of the towns enjoyed regular daily service.

If you are making travel plans from afar, it’s significant to know that not only are the towns, cities, and hamlets accessible, but they are reliably and frequently visited. You might have a UNESCO-rated Viking archaeological site on your list of must-sees, and you know you don’t have to rent a car to reach it. Nor do you have to fudge in extra time if your timing is off in such a way as to miss the one bus that goes through the area. A traveler doesn’t worry about contingency plans or estimate the risk of not having transportation.

Renting a car is possible, but it’s expensive, costing $60-$90 per day. And then you have to pay for gas and parking. A one-hour bus ride up to Lokken, a beach town on the North Sea, costs DK94, or just under $15 —seriously.

Lastly, you will find that the vehicles themselves are well-kept and clean. School children, teens, and adults of all ages trundle on and off them with noticeable familiarity. No need to fear being laughed at or judged for not following any particular protocol. Everyone is simply going about their day. Using the extremely reliable, well-networked, optimally supplied sources of transportation that their governing body chooses to provide with a substantial subsidy.

And more

Great architecture in Denmark

Aarhus City Hall, a classic of Danish Scandinavian Modernism, was designed by Arne Jacobsen and Erik Møller and completed in 1941, replacing an older, medieval city hall. A competition was held in 1937 to replace the increasingly insufficient town hall from the mid-19th century, leading to Jacobsen and Møller’s winning, intentionally unmonumental design. However, after public and political requests, a towering clock tower was added, and construction continued despite the German occupation of Denmark during World War II, making the finished building a symbol of democratic governance during that time.

When asked about Polanyi’s Double Movement- Claude said:

Polanyi’s Double Movement and the Evolution of Economic Thought

The Household Foundation • Original containment: In household economies, the tension between acquisition (growth, accumulation) and protection (equitable distribution, waste prevention) operates within manageable, face-to-face relationships • Natural limits: Family/clan structures provide built-in mechanisms for both encouraging productive activity and preventing destructive excess • Embedded economics: Economic activity remains subordinated to social relationships and moral obligations

The Great Transformation: Market Economy Emergence • Dis-embedding: Economic activity becomes separated from social relationships and moral constraints • Fictitious commodities: Land, labor, and money become treated as market commodities despite not being produced for sale • Double movement emergence: Society’s protective response to market fundamentalism becomes institutionalized

Evolutionary Responses in Economic Thought

Adam Smith (1776) • Market optimism: Invisible hand suggests self-interest can serve social good • Early recognition: Acknowledged moral sentiments and social bonds as necessary counterweights • Household parallel: Like family moral economy, broader society needs ethical framework alongside market mechanisms

Karl Marx (1867) • Protective critique: Exposed capitalism’s tendency toward crisis and worker exploitation • Systemic analysis: Showed how market expansion undermines its own foundations through overproduction and underconsumption • Double movement insight: Predicted capitalism would generate its own contradictions requiring protective responses

Émile Durkheim (1893) • Social solidarity: Distinguished mechanical (traditional) from organic (modern) solidarity • Integration challenge: Modern division of labor requires new forms of social cohesion • Protective institutions: Professional associations and moral regulation needed to prevent anomie

Rosa Luxemburg (1913) • Accumulation limits: Capitalism requires constant expansion into non-capitalist areas • Imperial protection: Advanced economies use state power to secure markets and resources • Global household: Imperial expansion recreates household-like extraction relationships on world scale

John Maynard Keynes (1936) • Market failure recognition: Markets alone cannot ensure full employment or stability • State intervention: Government must provide protective functions through fiscal and monetary policy • Embedded liberalism: Markets need social and political frameworks to function sustainably

Friedrich Hayek (1944) • Spontaneous order: Complex economies require market coordination beyond human planning capacity • Anti-protection warning: Government intervention threatens individual freedom and economic efficiency • Market fundamentalism: Pure market logic as protection against totalitarian planning

Contemporary Double Movement Tensions

Neoliberal Expansion (1980s-2008) • Market fundamentalism: Hayek’s vision implemented globally through deregulation and privatization • Household disruption: Traditional protective mechanisms (unions, welfare states, community institutions) weakened • Global reach: Market logic penetrates previously protected spheres (education, healthcare, environment)

Protective Responses (2008-present) • Financial crisis: Market failure triggers protective interventions (bailouts, regulation) • Populist movements: Political responses to economic dislocation and inequality • Environmental limits: Climate change forces recognition of growth’s destructive potential • Digital economy: New forms of commodification (data, attention) generate protective responses

Synthesis: The Persistent Tension

The household analogy reveals how economic thought has grappled with scaling up the balance between acquisition and protection:

• Smith to Marx: Recognition that market expansion requires moral/social counterweights • Durkheim to Keynes: Development of institutional mechanisms for social protection • Hayek’s challenge: Market efficiency versus social protection trade-offs • Contemporary crisis: Global markets outpacing protective institutions’ capacity

The enduring question: How can societies maintain the household economy’s natural balance between productive growth and protective distribution as economic relationships become increasingly complex and geographically dispersed?

Homeownership across Europe

The US homeownership rate hovers around 65%. But just as the above data table suggests, there are variations across regions and urban areas.

In the beginning

The term “economics” comes from the ancient Greek word oikonomia, which translates to “management of the household” (oikos meaning “house” and nomos meaning “law” or “management”). In ancient Greece, thinkers like Xenophon and Aristotle discussed economics in the context of managing household resources, including property, agriculture, and labor, to ensure the well-being of the family unit. This was a practical concept focused on efficiency and resource allocation within the home or estate, rather than the broader market-based systems we associate with economics today.

The word economics evolved from its original Greek meaning of “household management” (oikonomia) to a broader concept over centuries, with key shifts occurring as societies and intellectual thought developed. Here’s a concise overview of when and how this transformation happened:

• Ancient Greece (4th–5th Century BCE): As you noted, oikonomia referred to managing household resources, as discussed by thinkers like Xenophon and Aristotle. It focused on practical matters like agriculture, trade within the estate, and family welfare, with some extension to city-state (polis) administration.

• Medieval and Early Modern Periods (5th–17th Century): The concept remained tied to household or estate management in feudal Europe, but as commerce and trade grew, thinkers began applying similar principles to larger entities like manors or small states. The term wasn’t yet used for broader societal systems, but mercantilist ideas (1500s–1700s) started focusing on national wealth and trade, laying groundwork for a wider scope.

• 18th Century – Enlightenment and Classical Economics: The shift to a broader meaning took shape during the Enlightenment. In 1776, Adam Smith’s The Wealth of Nations marked a pivotal moment, redefining economics as the study of wealth creation, distribution, and consumption across societies. Smith and contemporaries like David Ricardo moved the focus from households to markets, trade, and national economies, emphasizing concepts like division of labor and free markets.

• 19th Century – Formalization of Economics: By the 1800s, economics solidified as a discipline studying societal resource allocation. Thinkers like John Stuart Mill and Karl Marx expanded its scope to include production, labor, and capital on a national and global scale. The term political economy was often used, reflecting its focus on state and societal systems.

• Late 19th–Early 20th Century – Modern Economics: The marginalist revolution (1870s) and the work of economists like Alfred Marshall further abstracted economics into a science of human behavior, choices, and resource scarcity. Marshall’s 1890 book Principles of Economics popularized the term “economics” over “political economy,” cementing its modern, broad meaning as the study of how societies allocate scarce resources.

But let’s not forget about the distinction of political economy—

The term political economy played a crucial role in the evolution of the word economics from its original Greek meaning of “household management” (oikonomia) to its modern, broader sense. Here’s how political economy fits into the sequence, building on the earlier discussion:

• Ancient Roots (4th–5th Century BCE): As mentioned, oikonomia in ancient Greece referred to household or estate management, with some application to city-state governance (e.g., Aristotle’s discussions of resource allocation in the polis). This laid the groundwork for thinking about resource management beyond the household, but the term political economy didn’t exist yet.

• Medieval and Early Modern Periods (5th–17th Century): During this time, economic thought was still largely tied to household or feudal estate management, but as trade and mercantilism grew, scholars began applying resource management principles to larger entities like states. The term political economy emerged in the early 17th century, particularly with works like Antoine de Montchrestien’s 1615 Traicté de l’oeconomie politique, which explicitly used the term to describe the management of state resources and wealth. Here, “political” referred to the polis or state, extending oikonomia to national governance, trade, and wealth accumulation (e.g., mercantilist policies focused on state power and gold reserves).

• 18th Century – Enlightenment and Rise of Political Economy: The term political economy became prominent during the Enlightenment as thinkers like Adam Smith, David Hume, and the French Physiocrats (e.g., François Quesnay) analyzed wealth, trade, and production at a societal level. In 1776, Smith’s The Wealth of Nations used political economy to describe the study of how nations generate and distribute wealth, focusing on markets, labor, and trade policies. This marked a clear shift from household management to the broader study of economic systems influenced by government policies, laws, and institutions. Political economy was the dominant term for what we now call economics during this period.

• 19th Century – Peak and Transition of Political Economy: In the early 1800s, political economy was the standard term for the discipline, as seen in the works of David Ricardo, John Stuart Mill, and Karl Marx. It encompassed the study of production, distribution, and consumption, often with a focus on how political structures (e.g., class systems, government policies) shaped economic outcomes. For example, Marx’s critique of capitalism in Das Kapital (1867) was framed as a work of political economy, analyzing economic systems through the lens of power and class dynamics. However, by the mid-to-late 19th century, the term began to be seen as too narrow, as it emphasized political and social factors over emerging scientific approaches to resource allocation.

• Late 19th–Early 20th Century – Shift to “Economics”: The marginalist revolution (1870s), led by economists like William Stanley Jevons, Carl Menger, and Léon Walras, shifted the focus to individual choices, marginal utility, and mathematical models of resource scarcity. Alfred Marshall’s Principles of Economics (1890) popularized the term economics as a more neutral, scientific label, dropping the “political” to emphasize the study of universal principles of resource allocation across societies. Political economy began to be seen as a subfield, focusing on the interplay of politics and economics (e.g., trade policies, labor laws), while economics became the broader discipline.

In summary, political economy emerged in the 17th century as an extension of oikonomia to state-level resource management, became the dominant term for economic thought in the 18th and early 19th centuries, and bridged the gap between household-focused economics and the modern, abstract science of economics. By the late 19th century, economics overtook political economy as the broader term, with political economy now often referring to a specific lens within economics that examines the role of political institutions and power in economic systems.

Is it politics? Is it the economy? Or is it some mix of the two?

Veblen’s pecuniary obsession

Thorstein Veblen, the Norwegian-American economist raised in rural Minnesota, left an indelible mark on social theory with his 1899 classic, The Theory of the Leisure Class. In that book alone, he wielded the term “pecuniary” over 200 times, hammering home his critique of money-driven motives in society. Makes you wonder: was Veblen subtly arguing that transactions fueled chiefly by monetary incentives carry a distinct, perhaps colder essence—diverging sharply from exchanges rooted in social bonds, reciprocity, or community welfare?

The economics of Kronborg Castle

Sure— you knew that Kronborg Castle, on the NE tip of Zealand in Denmark, was the setting inspiration for Shakespeare, in Hamlet.

But did you realize its raison d’etre is an economic story?

See that short distance from the edge of the ramparts to the coast afar? That’s a narrow strait— perfect for tax collection.

Kronborg Castle was constructed by Denmark to enforce the collection of “Sound Dues,” a tariff levied on all ships passing through the Øresund strait between Denmark and Sweden.

The castle’s cannons ensured that vessels complied, generating significant revenue for the Danish Crown for over 400 years.

Kronborg and the Sound Dues

- Strategic location: In the 1420s, King Eric VII of Denmark built a fortress named Krogen on the site of present-day Kronborg. The castle was strategically positioned on the narrowest point of the Øresund, which at just 4 kilometers (2.5 miles) wide, served as a crucial entryway to and from the Baltic Sea.

- Enforcement of tariffs: The castle and its formidable cannons guaranteed that all commercial ships entering or leaving the Baltic paid the Sound Dues.

- Revenue generation: For centuries, the Sound Dues were a main source of income for the Danish royals, funding not only the maintenance of the castle but also covering a significant portion of Denmark’s state income.

- Preventing fraud: To prevent ships’ captains from undervaluing their cargo to lower the tariff, the Danish king could exercise the right to buy the entire cargo for the value stated.

- Upgraded fortress: In the mid-1500s, King Frederick II radically expanded and rebuilt the fortress into the lavish Renaissance castle known today as Kronborg. The project was almost entirely funded by the Sound Dues.

Simple Tech

I don’t go to tons of museums, so perhaps this is not new. But using a large magnified mirror on a tilted platform to display a ceiling fresco is so effective!

Street Scene

The Music Professor

I like this guy. ‘Music is like a time machine.’

AirB&B on the side of a Bur Oak tree

Market Failure was used as the signal– but what now?

In days of yore, there was the market and the state. Two separate spheres of activity coexisted. And when private industry did not come through for the people, in the way they thought it should, market failure was the name given to assign blame. When the market failed, it was up to the state to address the lack of supply in areas such as medical care, poverty alleviation, housing, and the like.

One of economist Tyler Cowen’s first books addresses this trigger for state action in a compilation of thoughts on The Theory of Market Failure: A Critical Examination. But he isn’t convinced. He seems to say that when you look so closely at a tiny segment of a large system, you don’t see anything at all.

Consider externalities, a key signal that the market is merely pushing a problem onto some unsuspecting observer. He claims that (nearly) every single transaction has a positive or negative external effect. And, if you think about it, it’s true. We are social creatures. Although many consumptions are deeply personal, in the end, we always touch the lives of others.

The scope of the externalities/nonexcludability issue is vast. Nearly every concern of economic policy, from environmental considerations to research and development, involves externality problems. No one would claim that every instance of an externality warrants state intervention. There is no doubt, however, that the existence of externalities is one of the most powerful arguments for public sector involvement in the provision of public goods.

This isn’t the proper trigger for government intervention.

What about when the price seems too high, as in housing, or too low, as in wages? Whether a good is mediated through the private or public sector, prices still carry the most valuable form of comparative value information.

As noted earlier, the theory of public goods and externalities implies that if a good is characterized by nonrivalrous consumption, allowing additional individuals to consume it entails zero marginal cost. Demsetz’s arguments (1964; 1970) imply that this is only true in the presence of perfect information. Otherwise, allowing additional individuals to consume a good free of charge results in the abandonment of the price system in that sphere of activity. Since the publication of Hayek 1945, the role of prices in communicating information has been well known. In the provision of public goods as well as private goods, sacrificing such information may entail significant costs.

Prices are the most critical form of encapsulation of what groups of exchangers say about an exchange. We may not always conduct a thorough analysis of prices. That might be where the problem lies.

For instance, the exchange might be telling something vital about a group of people that others are simply not attuned to. People join various clubs throughout their lives. And these associations create structures of value.

The next two selections in section 2 of this volume discuss the nature of local public goods. Because such goods, by definition, can be provided to only a segment of a nation or community, determining which individuals will receive them becomes part of the economic problem. Once club or community membership becomes endogenous, many of Samuelson’s conclusions do not hold.

When people leave or join a club, when they exit or stay loyal, they impact how much of a surcharge the group of people in the club can charge.

The Tiebout model avoids the preference revelation problem; an individual’s preferences are revealed by his choice of location. It also avoids the free-rider problem; those who choose to belong to a given community are subject to the taxes or user fées that finance the provision of goods. Nor is pricing inefficiency a problem. If an individual is inefficiently excluded from the use of a public good or service, he can simply move to a community where that exclusion is not practiced.

The introduction written by Tyler Cowen is comprehensive. To the engaged observer, he dispels the dichotomy between industry and the state. There’s something pluristic out there. It’s big, messy, and complicated. It dovetails into many of the things people talk about under the titular of institutions. But it has structure– once you stand back and take a look.

That’s the project of the moment: a unified theory of price.

Market Design: For the Group or for the Individual?

We often think of markets as the ultimate expression of individual freedom—buy what you want, sell what you have, let prices sort everything out. But look closer at some of the most important markets in our economy, and you’ll notice something curious: they don’t work that way at all.

Take spectrum auctions. When the government sells radio frequencies, they don’t just post a “For Sale” sign and take the highest bidder. Instead, they craft elaborate auction mechanisms with complex bidding rules, eligibility requirements, and payment structures. Why? Because the goal isn’t just to make a sale—it’s to maximize revenue for taxpayers and ensure efficient allocation of a scarce public resource.

Or consider medical residency matching. Before the current system, medical students and hospitals engaged in an increasingly frantic and early scramble for positions that left everyone worse off. Now, students submit ranked preference lists, hospitals do the same, and an algorithm produces matches that no student-hospital pair would want to trade away from. Individual students might not get their first choice, but the system as a whole works better for everyone.

These aren’t broken markets that need fixing—they’re markets deliberately designed to serve collective goals while still respecting individual preferences. And they represent a fascinating middle ground.

The Pattern Emerges

Look across the landscape of market design and you’ll see the same pattern everywhere:

Electricity markets must ensure grid reliability and efficient dispatch while still letting generators and consumers pursue profit and savings. Emissions trading systems must hit environmental targets while allowing companies to minimize their compliance costs. Kidney exchange networks must save as many lives as possible while respecting individual donor and recipient preferences.

In each case, there’s a collective goal that matters—revenue maximization, system stability, environmental protection, saving lives—but also individual participants who won’t play unless they can pursue their own interests.

The Design Challenge

This creates a fascinating design challenge. How do you interpret a market that serves group goals while still harnessing individual incentives? The answer lies in the mechanisms that align private interests with public purposes.

Traditional markets work through the “invisible hand”—individual optimization magically leads to collective benefit. But in these designed markets, there’s a very visible hand carefully crafting the rules to ensure that what’s good for individuals adds up to what’s good for the group. The group is the primary competitive player.

A New Taxonomy

Perhaps we need to think about markets along a spectrum. On one end are pure private optimization markets—commodity exchanges, stock markets, your local farmer’s market. Here, individual pursuit of profit and value drives everything, and collective benefit emerges as a byproduct.

On the other end are what we might call “group-goal-constrained markets”—auctions, matching systems, environmental markets. Here, collective objectives take priority in the design, but individual incentives are carefully preserved and channeled toward those broader goals.

This isn’t about eliminating private goals or replacing markets with central planning. It’s about designing institutions that make private and public interests align. The medical student still wants a good residency. The electricity generator still wants profit. The polluting company still wants to minimize costs. But the market structure ensures these individual pursuits nod up to group purposes.

The Future of Markets

As our economy becomes more complex and interconnected, we increasingly need markets that can serve collective purposes while still harnessing individual incentives. Climate change, healthcare allocation, urban planning, financial stability—these challenges require coordination at a scale.

Market design offers a path forward: not the heavy hand of government control. We’re learning to interpret markets that work for everyone precisely because they’re designed to balance what individuals want with what society needs.

The invisible hand was never really invisible—it was just poorly understood. Now we’re learning to make it work more deliberately, and that might be exactly what our complex world requires.

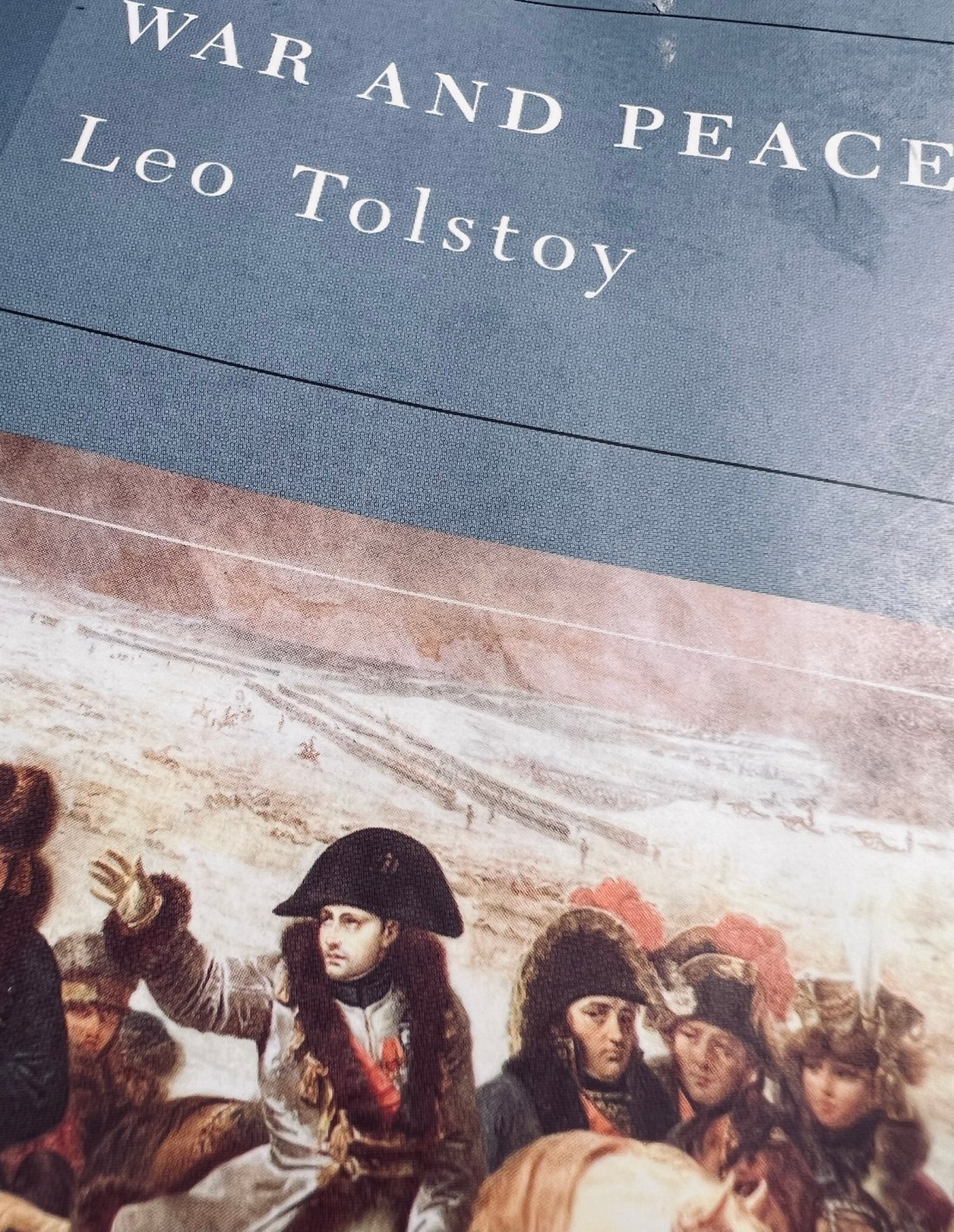

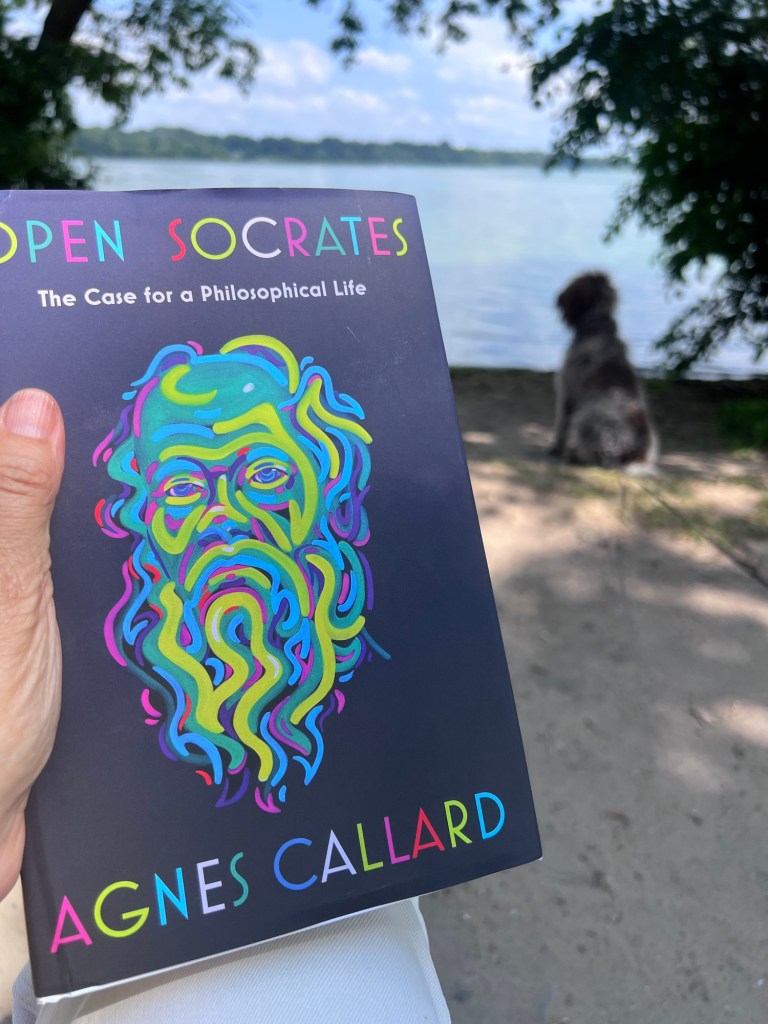

Getting to the right book

Sometimes you look, and look, and look before you get to the right book!

Public or Private?

Tolstoy, and the X side of warfare

A topic under examination that runs through War and Peace is the analysis of warfare. What were the keys to Napoleon’s success? The size of the army, or the genius of the man? Or something else.

In Part 15, chapter II Tolstoys starts us we thinking in terms of individual agents.

ONE OF THE MOSt conspicuous and advantageous departures from the so-called rules of warfare is the independent action of men acting separately against men huddled together in a mass. Such independent activity is always seen in a war that assumes a national character.

The author then tells us the accepted view is that it is about counting soldiers, guns, and supplies.

Military science assumes that the relative strength of forces is identical with their numerical proportions. Military science maintains that the greater the number of soldiers, the greater their strength.

But…

Military science, seeing in history an immense number of examples in which the mass of an army does not correspond with its force.

And thus Tolstoy suggests there is something else. He wants to be scientific about this thing. He calls it X.

One has but to renounce the false view that glorifies the effect of the activity of the heroes of history in warfare in order to discover this unknown quantity, x.

X is the spirit of the army, the greater or less desire to fight and to face dangers on the part of all the men composing the army, which is quite apart from the question whether they are fighting under leaders of genius or not, with cudgel or with guns that fire thirty times a minute.

It seems that what is important here is that soldiering with X is something different than soldiering in general. To fulfill a duty with X is not the same as a run-of-the-mill fulfillment of the same task. It does not quantify in the same way or lead to the same results. Labor with a purpose or a shared ambition deserves a subscript of x.

Unit One— Series Review

This Scandi noir cop series from 2000 features a strong cast and solid plotlines. But that’s not what makes it interesting. The special investigation team works out of a mobile trailer, which travels to the location of the crime. Any travel enthusiast will appreciate the insights into towns, villages, and the larger cities all over Denmark. A viewer might even take to referring to Google Maps at the start of each episode as the investigation becomes apparent.

The changing roles of women and household composition also thread through the background of each episode. It’s hard to remember that it was a big deal for a woman to be made head of the homicide unit just twenty-five years ago. Whether in conjunction with women’s advancements or not, the flagrant mate swapping verges on humorous. There are absolutely no traditional family structures. Flirtations and infidelities and reunifications are the going thing.

Control price, Property will degrade to reflect change

Barry- my first, my last

Territory-Watersheds for Insurance

In the context of car insurance pricing, a territory is a geographic area defined by insurers to group locations with similar risk profiles for setting premiums. Territories are typically defined using the following methods and delineators:

1. ZIP Codes: The most common delineator, as ZIP codes provide a standardized way to segment areas based on localized risk factors like accident rates, crime statistics, and claim frequency. Insurers may use individual ZIP codes or aggregate them into larger territories. [2] [16] [19]

2. Custom Territories: Insurers may create their own territories by combining ZIP codes, counties, cities, or townships into broader zones. These are designed to reflect similar loss experiences, traffic patterns, or demographic characteristics. For example, multiple adjacent ZIP codes with comparable risk may be grouped into one territory. [11] [13] [14]

3. Census Block Groups: For more granular analysis, some insurers use census block groups (small areas with 600-2,000 people) to define territories. These allow for precise risk assessment in densely populated or diverse areas. [16] [19]

4. State-Regulated Territories: Some states impose rules on how territories are defined. For instance, Connecticut uses 18 predefined territories, while California requires territories to be at least 20 square miles and prohibits single-ZIP code territories to ensure fairness and avoid overly specific pricing. [13] [14]

5. Geocoding: Insurers use geocoding tools to map a vehicle’s primary garaging address (where it’s parked most often) to precise coordinates, ensuring accurate assignment to a territory. This helps account for variations within larger geographic units. [18]

Territories are defined based on data like accident frequency, vehicle theft rates, vandalism, weather risks, traffic density, and claims history, which help insurers assess the likelihood and cost of claims in a given area. The boundaries are set to balance statistical homogeneity with practical considerations like regulatory compliance and administrative simplicity.

State Fair Season

With nearly 500 food items, 30 carnival rides, and more than 900 free performances, there’s plenty to keep you busy throughout the Minnesota State Fair‘s 12-day run.

It’s a thing here in Minnesota. All walks of life mingle through the entrance gates in Falcon Heights. Check out the one day attendance record.

The Brief

-

- The Minnesota State Fair saw its first record-breaking attendance day so far this year.

- On Monday, 145,022 people were recorded attending the fair.

- This breaks the previous record of 144,504 people set in 2017.

The cost of uncertainty

I showed a house this week in a modest but well-situated neighborhood. It had some problems, but mostly superficial– carpet, paint, appliances, and the like. Yet, even at a price below the comparable sales, it remains on the market. What? Uncertainty.

The property has been through a foreclosure, and as the tax records show, the bank holding the paper, Midfirst Bank, repurchased it. But this is a murky ownership situation.

At a sheriff’s sale, the buyer is not immediately given a full and clear ownership title the way they would in a normal real estate closing. Instead, the buyer typically receives one of two legal instruments depending on the state:

- Sheriff’s Certificate of Sale (common in states like Minnesota)

- This document shows that the buyer purchased the property at the sheriff’s sale.

- It is not a deed and does not yet transfer full title.

- The original owner still has a redemption period (often 6–12 months, depending on the type of property and state law) to pay off the debt and reclaim the property.

- Sheriff’s Deed

- If the redemption period expires without the former owner redeeming the property, the sheriff’s certificate is converted into a sheriff’s deed (sometimes automatically, sometimes requiring a filing).

- The sheriff’s deed conveys whatever interest the debtor had in the property to the buyer, but it usually comes without warranties of clear title. That means the buyer takes the property subject to existing liens, unpaid taxes, or other encumbrances, unless state law says otherwise.

The property is being marketed by the owner who went through foreclosure, even though their right to the property is only through redemption. They would have to find a buyer to settle the full amount owed to Midfirst. This middle-ground ownership area makes the market uneasy. What if the bank wants more than the sheriff’s sale for fees and expenses? What if the property’s condition deteriorates between the offer and closing? Who will handle the repair? Will the title transfer be handled properly in the end?

Minnesota’s foreclosure rate is very low at one-half of one percent of the housing stock. So these sales are rare, and an investor will undoubtedly find it worthwhile to take on as a project. But in areas with insecure property rights and poor banking relations, the surcharge for uncertainty carries a hefty surcharge.

Only ideas trump ideas

Agnes Callard: ‘Exsanguinating the bodies of people who hold an idea is not a way of getting at the idea itself, and preventing them from being exsanguinated doesn’t preserve the idea. Killing and saving don’t touch ideas: only argument does.’

Blessings

Blessed are those who mourn, for they shall be comforted – Matthew 5:4

Marriage is good for real estate

From the National Association of Realtor’s Buyer Report:

62% of recent buyers were married couples, 20% were single females, 8% were single males, and 6% were unmarried couples.

I wonder what kind of spread Travis and Taylor will end up with?

New Construction Update

Twice a year, builders in the Twin Cities Metro (and beyond) open up their model homes in an organized event to bring potential buyers out to browse.

More than 300 new homes in the Twin Cities and Rochester will be on display as part of the 2025 Fall Parade of Homes, according to Housing First Minnesota.

The event — which runs Fridays through Sundays from Sept. 5 through Sept. 28 — features homes built by 76 builders in 76 cities. Home prices range from $299,900 to more than $3 million.

Also planned is the Remodelers Showcase, which will be open on the final weekend of the tour. The showcase will feature 32 “home transformations,” including one remodeled “Dream Home” in Excelsior, according to Housing First Minnesota. (Finance and Commerce)

A lot of folks are window shopping. Builders pay designers to select the best paint colors and tile selections. It’s interesting to see if builders are betting on a new floor plan. Some years, the appliance styles make a dramatic switch, like going from stainless to white. People are curious. People are making plans for their own home improvements.

And some people really will build that brand new home they’ve always wanted.

The Public and The Private- electric edition

From Your Home to the Grid: Who Owns and Operates the Power System

When you pay your monthly electric bill, you’re acting as a private consumer in the electricity market. To you, the relationship looks simple: you use electricity in your home, and you pay your local provider for it. But behind the walls of your house is a layered system of ownership and responsibility—households, retail providers, wholesale markets, and the grid itself—all working together to keep the lights on.

Households: Private Buyers

At the household level, the role is clear: you buy electricity as a private party. You don’t own the power lines in your yard, the substation down the road, or the generating plant hundreds of miles away. Your responsibility begins and ends at the point where electricity enters your home. Your choice in the matter is limited—most households don’t pick their provider directly, unless they live in a state with retail competition. Still, you form judgments about reliability and cost, and those perceptions influence how you view your community’s services overall.

Retail Providers: Local Operators

Your local utility—the company whose name is on your bill—owns and maintains the distribution network that connects households to the grid. These companies come in different forms:

- Investor-owned utilities (IOUs): Private corporations accountable to shareholders but regulated by state commissions.

- Municipal utilities: City-owned providers accountable to residents through local government.

- Rural cooperatives: Member-owned organizations governed democratically by the people they serve.

Each owns the poles, wires, transformers, and meters in their service area. Their job is to ensure safe, reliable delivery of power to your home, while also balancing infrastructure costs with customer affordability.

Generators and the Wholesale Market

The electricity itself originates with power plant owners—companies that run gas plants, wind farms, solar arrays, hydro dams, or nuclear stations. They sell their output into regional wholesale markets. Ownership here is diverse: it may be a private energy company, a public authority, or an independent producer. Retail utilities buy from these generators, sometimes through long-term contracts, other times through daily market transactions.

The Grid: Shared Infrastructure

The “grid” refers to the transmission network that carries bulk electricity over long distances. Ownership here is shared, too. High-voltage lines and substations are owned by transmission companies, often subsidiaries of investor-owned utilities. Oversight and coordination, however, rest with regional transmission organizations (RTOs) or independent system operators (ISOs). These bodies don’t own the lines; they operate them, ensuring the system is balanced and fair access is maintained.

Above them, the Federal Energy Regulatory Commission (FERC) provides national oversight, while state commissions regulate local distribution and retail rates. In this sense, the grid is a patchwork of physical assets owned by many companies, but coordinated as a single machine for reliability.

A Household’s Place in the System

So, while your home participates as a private buyer, every other level—local utilities, generators, transmission owners, and grid operators—has its own structure of ownership and accountability. The result is a complex but interdependent chain: private households at the end, backed by local, corporate, cooperative, and government players. Each layer has different incentives, but all share the responsibility of ensuring that when you flip a switch, the power is there.

Zap

If you’ve ever had to dig in your yard, you know the first step is to call the power company. Before a shovel hits the dirt, utility crews mark the lawn with a rainbow of little flags, showing where buried lines and cables run. Those markers are a reminder that beneath every property lies a web of infrastructure you don’t own but rely on every single day. This network is owned and maintained by your local electric company—the same one that sends you a monthly bill. Whether electricity enters your home through an overhead mast or a buried cable, the reliability of service rests with these local players.

Behind the Flags: How Power Reaches Homes

The electricity that hums through a house begins far away, at generating stations powered by natural gas, wind, solar, hydro, or nuclear energy. High-voltage lines move that power long distances until substations step the energy down to safer levels. From there, your local utility takes over, operating the distribution system that delivers electricity to neighborhoods and households.

For homeowners, the poles you see on the street—or the lines you don’t see underground—are not just background scenery. They are the lifelines of everyday living. Flicking on a light switch, charging a laptop, or running an air conditioner all depend on the quiet, constant work of utilities keeping those lines in good order.

Reliability and Perception

While utilities don’t often feature at the top of a buyer’s checklist the way school districts or commute times do, reliability still shapes homeowner perception. Most people only notice electricity when it fails, but repeated outages or slow restoration times can quickly create frustration. Just like trash pickup or snow plowing, electricity is a municipal-style service that residents take for granted—until it stops.

In this sense, dependability forms a kind of background preference. A household may not choose a neighborhood primarily for its utility provider, but they still form judgments, even if peripheral, about whether the service is reliable, responsive, and trustworthy. When those expectations aren’t met, the dismay can be just as real as when other civic services break down.

The Household–Utility Relationship

Every month, the bill you pay reflects both the energy you used and the infrastructure behind it. Rates cover not only the electricity itself but also the upkeep of poles, wires, substations, and the crews ready to respond when trouble strikes. For families on tight budgets, these costs can feel heavy, which is why many utilities offer assistance programs or rebates to help households manage expenses.

More Than Wires

Ultimately, the connection between utilities and homes is about more than cables and meters. It’s about ensuring every household can reliably plug into modern life. From the flags in your lawn to the wires above your street, utilities provide the unseen backbone of comfort, safety, and opportunity—making sure that when you flip the switch, the lights always come on.

Night Sky

It’s dark out! So I gave my iPhone a try at constellation photography. Not outrageous, but still satisfactory.

According to NPR, here’s the reason for the bright lights.

There are “blood,” “super” and “blue” moons, and then there’s the “black” moon.

The “black moon,” a rare phenomenon that occurs during a new moon phase of the lunar cycle, will occur this weekend. But don’t get your hopes up too much, scientists say, because it will be technically invisible.

It’s unclear when it was coined, but “black moon” is an unofficial astronomical term. A new moon is considered by some to be a black moon one of two ways. It can happen when a new moon appears twice in one month (new moons usually happen once per month) or when there are four new moons in one season. When there are four new moons in one season, the third new moon is called a “black moon.”

Tariffs on Timber

Many home builders, contractors and retailers wagered that higher U.S. tariffs on imports would boost the cost of lumber, while lower interest rates would lift demand for the building material.

But those bets have failed to pay off — and lumber prices have tallied a steep decline from a record high reached only three weeks ago. MarketWatch

Of course, there’s more than just tariffs in play in the market. Housing demand is down. Many new owners tackle renovations in the first months of home ownership. Fewer sales mean fewer renovations.

The market had rallied on classic “buy the rumor, sell the fact” action, he told MarketWatch. Prices for lumber had been higher just a few weeks ago based on the idea that tariffs were going to be attached to lumber and people were going to have to pay substantially higher costs — yet the underlying demand isn’t there, Kuta said.

People also overestimated where interest rates would be and their impact on lumber demand, which continues to slide lower, he added, with the “swing and a miss” he referred to based on housing statistics and earnings for publicly traded companies that supply lumber.

For now, the addition of tariffs has not resulted in the anticipated price increase. So what’s the takeaway? Hire contractors and get that house addition done! Lumber prices, a main component in construction, are down because demand is down, which on turn means contractors are looking for jobs– it is time to build.

Best Bird App

I love the Merlin ID app by Cornell Lab.

Everyone can make out a mallard or spot a majestic eagle, but this chirp identifier lets you identify all the smaller or lesser know creatures perched in your backyard foliage.

Just tap on the green arrow, and a recording starts. Every time a song is picked up, the bird ID flashes below.

Then you can replay the recordings to become familiar with all the different calls.

Another free educational service brought to you through new technology and the drive for data.

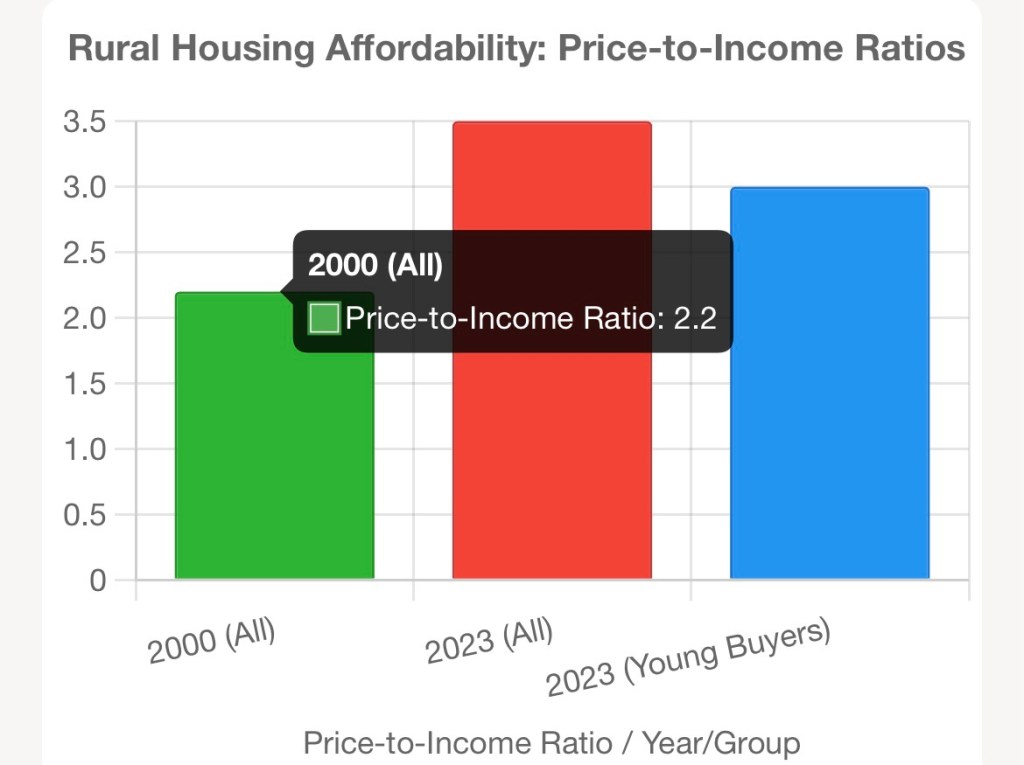

The Cascade Effect: Unlocking Housing Affordability

Housing markets often seem mysterious, but at their core they operate as a cascading system shaped by wealth, supply, and lending rules. A recent model by Abramson and Landvoigt highlights how rising wealth inequality and slow housing supply interact to push prices upward. Their framework divides housing into quality tiers, from luxury to starter units, and shows how households with different levels of wealth compete across these tiers.

A central insight is that prices at the very top do not stay isolated. Luxury buyers are a small share of the market, and in some sense they simply bid against one another for exclusivity. One might argue that they are “fools” for paying such large premiums, while the rest of the market should remain relatively affordable. But in practice the tiers are linked. When supply of luxury units is restricted, affluent households who cannot find space at the top tier shift down into the next-best homes. That displacement triggers a chain reaction: middle-income households face stiffer competition, prices at their tier rise, and the pressure filters all the way down to lower-income renters. Economists call this the filtering or musical chairs effect, and it means that adding supply at the high end can improve affordability across the board.

This cascading dynamic is exactly what makes the market work. New supply at any tier frees up units that can be occupied by someone else, allowing households to sort themselves according to means and preferences. The danger arises when either end of the ladder is blocked. If new high-end supply is not built, the wealthy bid down-market and crowd out others. If older or more affordable stock is neglected, the bottom rungs collapse and low-income households are left without viable options.

At the same time, credit standards shape who can actually buy. A household that cannot afford the payments will not receive a loan, which protects individuals from becoming dangerously over-leveraged. But this underwriting filter does not stop prices from rising overall; it only determines who gets excluded. The clearing price is still set by those wealthier households who can obtain financing. Those priced out of ownership often remain in the rental sector, where demand pressures drive rents upward as well.

Taken together, the picture is less about a simple split between the rich and poor and more about a tightly connected cascade. Housing affordability depends not only on overall supply but also on how well each rung of the ladder is maintained and allowed to expand.

An oldie but a goodie

The associational role- Tolstoy Edition

Pierre explains to the Freemasons.

“The whole plan of our order should be founded on the training of men of character and virtue, bound together by unity of conviction and aim,— the aim of suppressing vice and folly everywhere by every means, and protecting talent and virtue, raising deserving persons out of the dust and enrolling them in our brotherhood….”

The Reality of Minnesota’s Housing Market: Data Over Drama

Is affordability really an issue?

The narrative of a housing affordability crisis in Minnesota deserves scrutiny when examined against the actual data. The numbers tell a remarkably different story than the one often presented in policy discussions and media coverage.

The fundamental reality is this: 99.82% of Minnesotans are housed. With approximately 5.7 million residents and only 10,522 experiencing homelessness according to the most recent Minnesota Homeless Study, the state has achieved what many would consider a housing success story. This isn’t a marginal victory—it represents one of the most successful housing outcomes in the nation.

Supply Meeting Demand

Perhaps even more telling is the relationship between housing supply and population growth. Over the past five years, Minnesota’s housing stock increased by 3.87% while the adult population grew by 3.90%. This near-perfect alignment suggests that new construction is effectively matching new resident demand—a fundamental indicator that the housing market is functioning properly.

This supply-demand balance contradicts claims of a systemic housing shortage. When housing supply keeps pace with population growth, market forces should theoretically maintain relative affordability absent other significant economic disruptions.

The Missing Financial Stress Evidence

Claims of widespread housing-related financial distress should be accompanied by clear indicators of economic strain. Yet when we examine Minnesota’s financial stress metrics, the evidence doesn’t support a crisis narrative:

Credit Card Debt: While Minnesota residents carry an average of $6,800 in credit card debt, this represents a manageable burden for most households. Only 6.65% of Minnesotans are behind on credit card payments—a figure that, while not negligible, hardly suggests widespread financial collapse.

Payday Loans Eliminated: Rather than seeing increased desperation borrowing, Minnesota has essentially eliminated its payday loan industry through regulatory action. The state capped interest rates at 36% APR in 2024, driving out predatory lenders who previously charged an average of 202% annually. Payday America, which handled two-thirds of the state’s payday loan volume, simply stopped operating in Minnesota. If financial stress were truly endemic, we would expect to see increased demand for these services, not their market elimination.

Bankruptcy Filings: While March 2024 saw 731 bankruptcy filings—the highest since March 2020—this represents a return to pre-pandemic levels rather than an unprecedented crisis. The temporary reduction during the pandemic was likely due to federal assistance programs and eviction moratoriums, making the current numbers a return to historical norms rather than evidence of new distress.

The 30% Rule: An Arbitrary Standard

The frequently cited “30% rule”—that housing should consume no more than 30% of household income—deserves particular scrutiny. This threshold traces back to the United States National Housing Act of 1937, developed for public housing eligibility criteria nearly 90 years ago.

As household finance expert Andrés Shahidinejad notes: “There’s no scientific basis or magic reason for (30%) being a cutoff.” Fortune magazine has called the rule “arbitrary and not very helpful for policy makers.” The standard was created in an era of dramatically different household economics, employment patterns, and lifestyle choices.

Modern households make different tradeoffs than their 1937 counterparts. Some prioritize location and are willing to spend 40% or 50% of their income on housing in exchange for shorter commutes, better schools, or urban amenities. Others prefer larger homes in less expensive areas. These are choices, not evidence of crisis.

Reframing the Conversation