Prompted from Chat

December 2024 Sees a Surge in U.S. Housing Starts

After a challenging year, U.S. housing starts saw a 15.8% surge in December 2024, reaching an annualized rate of 1.50 million units. This growth was largely driven by a 61.5% rebound in multifamily construction, while single-family starts rose 3.4%. Despite this late-year boost, overall housing starts for 2024 fell 3.9% compared to 2023, reflecting a cooling market due to higher mortgage rates and construction costs.

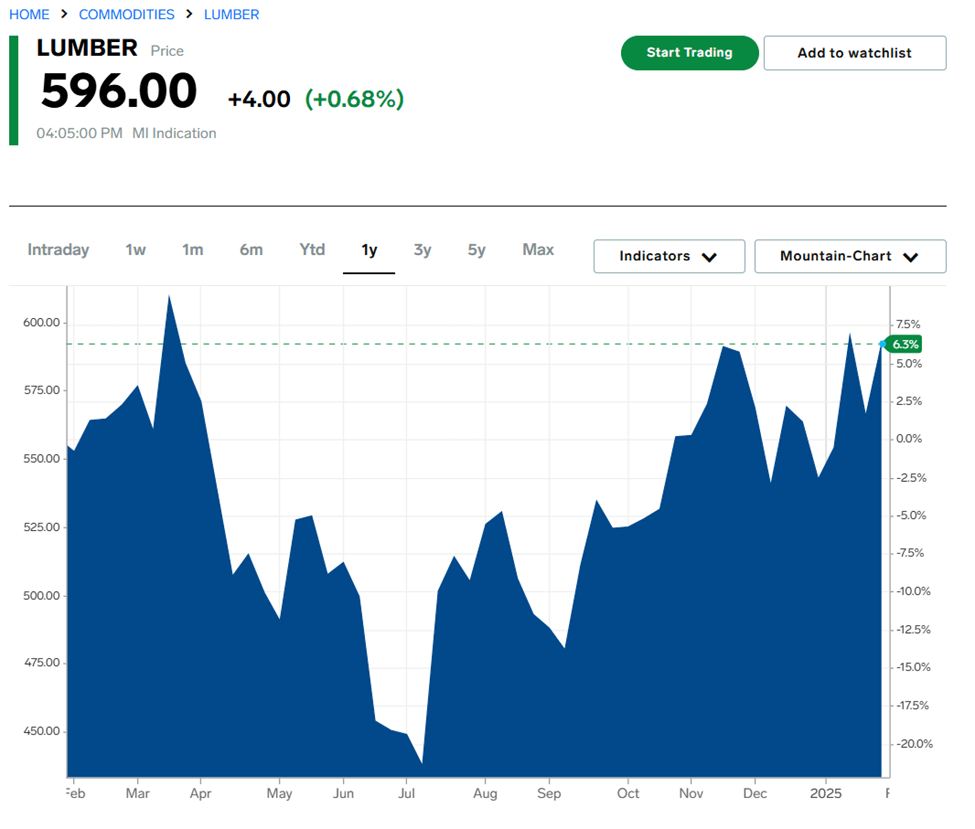

A significant portion of the lumber used for home construction in the U.S. still comes from Canada, accounting for 25-30% of total softwood lumber consumption. However, the cost of lumber has fluctuated. Over the last year, lumber prices have declined from elevated levels seen in 2022-2023, as supply chains improved and housing demand adjusted. As of early 2025, lumber prices are around $538 per thousand board feet, down from previous highs but still above pre-pandemic averages.

Trade policy remains a critical factor. In August 2024, the U.S. increased tariffs on Canadian softwood lumber from 8.05% to 14.54%. Additionally, a new 25% tariff on Canadian and Mexican imports, set to take effect in February 2025, could drive costs higher. These tariffs may slow future building starts as material costs rise, impacting affordability and overall construction activity.

While December’s surge in housing starts is promising, builders must navigate ongoing supply chain challenges and policy shifts that could influence construction costs in the months ahead.