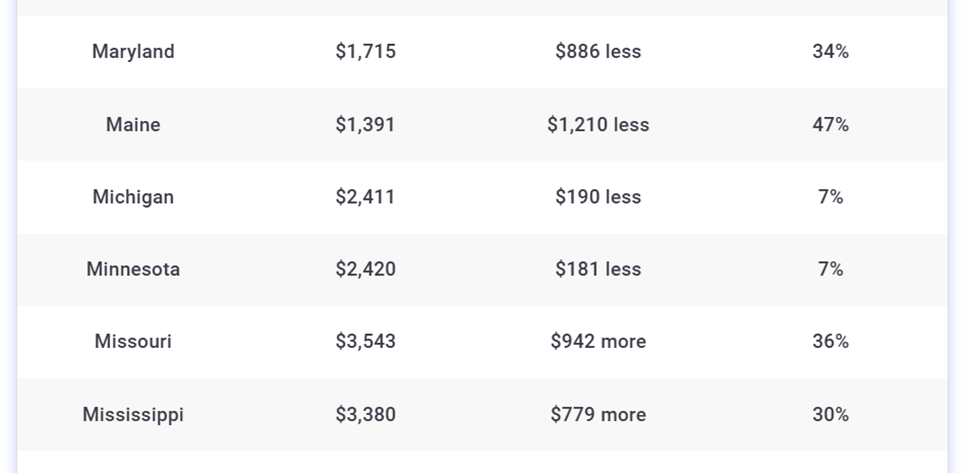

Come to find out, property insurance rates on a $300,000 home vary by state. They vary a lot. The annual premiums for a dwelling in Missouri and Mississippi are twice as much as Maryland and Maine. Minnesota is, of course, just average.

If you haven’t thought about your insurance coverage in a while it might be an idea to dust off the policy and dig into what is covered. Some riders are negligible in cost yet nice to have when the situation arises. And example for coverage is on the water line from the meter in your basement to the connector at the street. Standard deductibles have also gone up from $1000 to $2500. The larger deductible may save your annual premium $200-$300.

Also, be sure to understand how the coverage works. With all the roof claims, often driven by contractors knocking on doors after a hailstorm goes through a neighborhood, companies have changed the payouts on roof replacements. Many companies will prorate the coverage once a roof is over fifteen years old. If the storm comes through in the twentieth year of the asphalt shingle life, then the homeowner only gets paid the value of the remaining years of life.

A periodic review is indeed essential for staying informed about external factors that may affect your insurance coverage. Even if you are content with your current provider, the insurance market continuously evolves, making regular evaluations crucial for ensuring that your coverage aligns with your needs and the prevailing circumstances.