In many cases, mortgage companies require an appraisal on a property before lending money against it. This involves a professional appraiser touring the property, taking many measurements, and then compiling a report which is often a dozen pages in length.

Although there are three methods listed as options to determine value, the most prevalent one by far is the use of comparables. The income approach, which, as the name implies, relies on backing a value out of the stream of income from rents. But a single family residential is purchase for owner occupants rather than investors, so that method doesn’t make as much sense. Nor does the cost approach. If one were to estimate the cost to build a 70’s split or a 1920’s craftsman, the differentiators quickly make the analysis impractical.

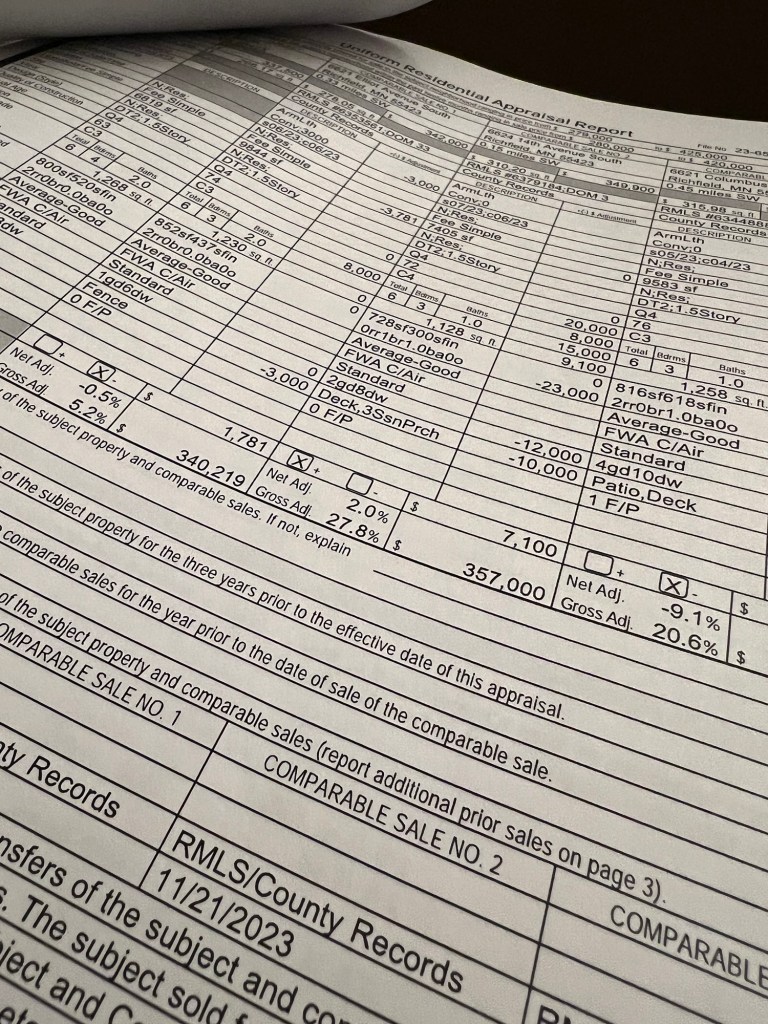

Thus the method du jour is to find three near-by properties of similar size and imporvements which have sold within the last six months. A tabular comparison is done as seen in the photo to make adjustment for variances. A deck was worth a $10K swing. Footage, bedrooms, baths, condition and so are tweaked up and down the columns. Once the number are in place, a tally at the bottom gives a range which justifies the buyer’s purchase price and allows the lender to happily lend against the home.

As long as the property is in a fairly large area of similar homes, this approach works well. But when there are none close-by which resemble the one in question, things get stickier for the appraiser. The one significant factor taken for granted in the comparison method is that the area is the same. Change areas, and foundational assumptions are out the window.